Business Insurance in and around Warren

Warren! Look no further for small business insurance.

Almost 100 years of helping small businesses

This Coverage Is Worth It.

Do you own a dance school, a lawn care service or a barber shop? You're in the right place! Finding the right coverage for you shouldn't be risky business so you can focus on what matters most.

Warren! Look no further for small business insurance.

Almost 100 years of helping small businesses

Small Business Insurance You Can Count On

When one is as dedicated to their small business as you are, it is understandable to want to make sure all bases are covered. That's why State Farm has coverage options for commercial auto, surety and fidelity bonds, commercial liability umbrella policies, and more.

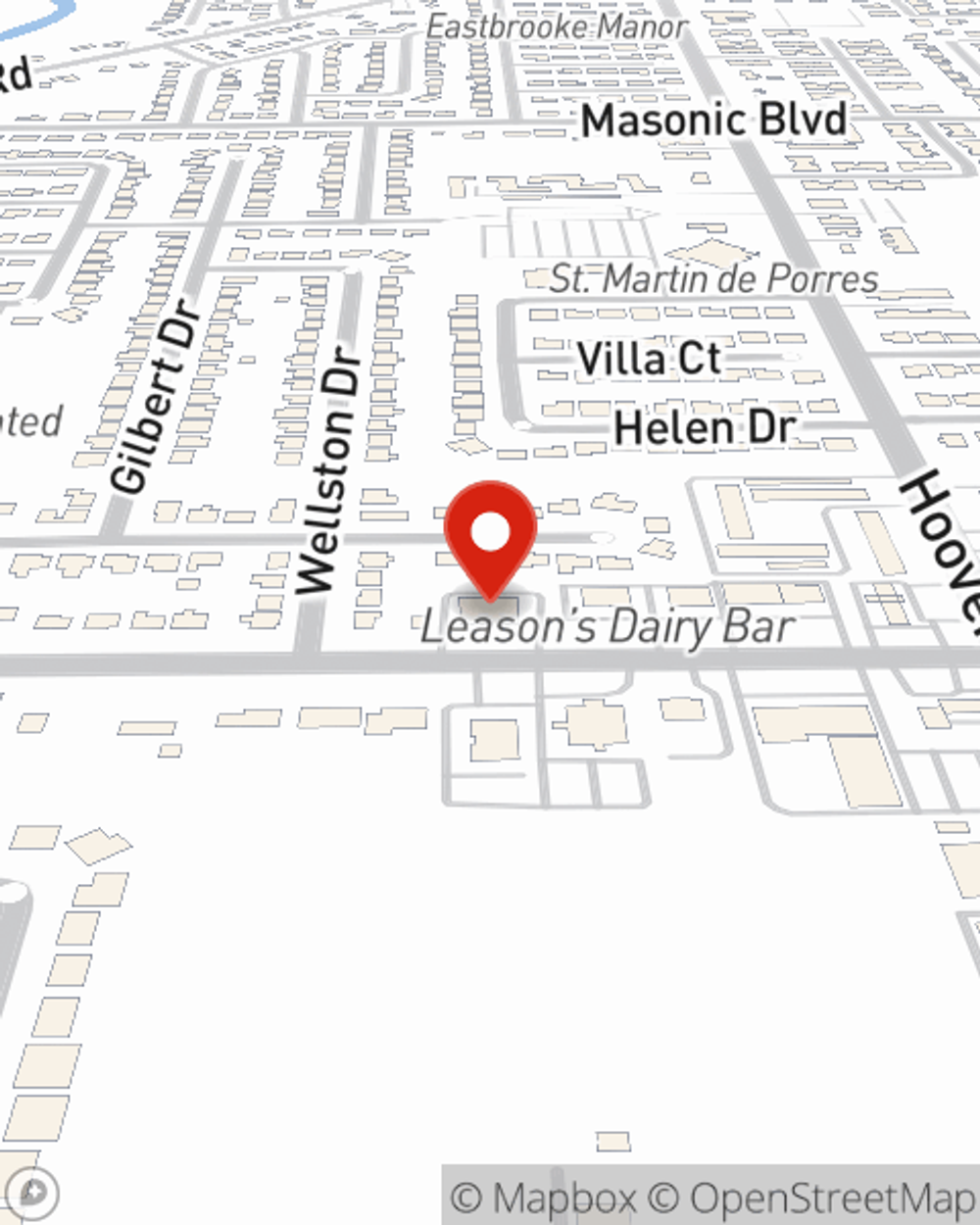

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Jane Wentz Rutman is here to help you review your options. Reach out today!

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Jane Wentz Rutman

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.